Turnover Tax: What You Need to Know

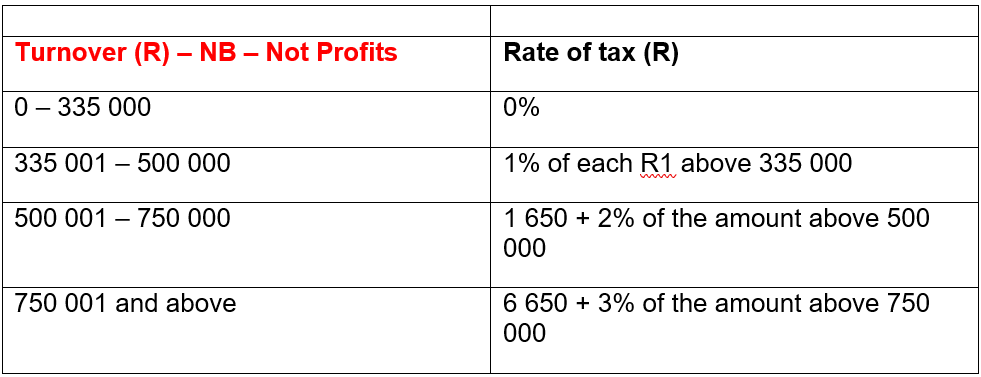

/If you are registered as a company or sole proprietor in South Africa, you can choose to pay either standard small business income tax rates or elect for turnover tax. Turnover tax is a simplified tax rate aimed at reducing administration for small businesses with an annual turnover of less than R1 million. If your turnover goes over R1 million, then you will need to register for VAT and pay tax on the standard tax rates.

You can be registered for turnover tax and also be registered for VAT (voluntary registration).

To make record keeping easier, the turnover tax system automatically estimates a company’s business expenses when calculating taxable income. This means businesses registered for turnover tax don’t need to track and report their tax-deductible expenses.

Also, small business owners will usually pay a lower tax rate under the turnover tax system than the standard tax system, and may not even have to pay tax at all depending on their annual income.

For many small business owners, there are advantages to opting for turnover tax over the standard small business tax.

Do this quick test to see if you will qualify for turnover tax.

However, keep in mind that expenses are purely an estimation under the tax turnover system. If you have very high tax-deductible expenses that would reduce your taxable income significantly, it may be in your best interest to claim them under the standard tax system.

There isn’t a one-sized solution that fits all. Consider your business situation and make the right decision for you.

One big advantage of turnover tax is that you don’t need to keep all your documentation to support your expenses.

The following records must be kept if you are on turnover tax:

Records of all amounts received.

Records of dividends declared.

A list of each asset with a cost price of more than R10,000 at the end of the year of assessment as well as of liabilities exceeding R10,000.

If you would like to see if you qualify or would benefit from turnover tax, please get in contact with us.

What can I deduct as business expenses for tax?

According to SARS, tax-deductible business expenses are any expense incurred in the production of income or in the running of the business.

For example, stock bought for resale is considered a business expense or stationery bought for the office is also considered a business expense. You must keep a record of these business expenses.

In South Africa, whether you’re registered as a company or a sole proprietor, you can claim business expenses on your taxes. Freelancers who work from home can also claim valid expenses.

If you run a business as a sole trader:

a) Day-to-day business expenses

These are general day-to-day office or business expenses, including items like stationery, petrol, and internet.

These expenses should all fall into one of the following categories:

material and equipment costs

employee costs and administration costs

office rental costs

office supplies

phone and internet costs

travel and transport, including business vehicle running costs

uniforms and PPE

wholesale purchase costs for inventory

financial charges (such as bank fees)

electricity, water and other utilities

security costs

cleaning costs

legal fees

insurance fees

marketing, advertising and promotional expenses.

Other

The cost of staff training that directly relates to their role at the company can be claimed as a business expense

Entertainment costs for clients can deducted i.e. drinks, meals or live entertainment – you must be able to prove that these costs where in the production of income

Business start up costs – this is costs before you started trading that you had to incur to start the business

b) Capital expenses

These are large expenses that don’t crop up on a daily or monthly basis. Usually, these long-term expenses are budgeted for well in advance. Examples include:

equipment and machinery

business vehicles

renovation costs

hardware, such as computers

signage

If you are a commission earner

SARS allows commission earners to deduct all commission-related expenses against their commission income. This includes expenses such as telephone usage, petrol, accommodation, wear and tear, and entertainment.

You’ll need to prove that these expenses were directly related to your commission work. SARS has been known to flag these claims due to previous abuse of the system, especially for more vague claims like entertainment.

Claiming home office expenses

If you work from home, there are home office expenses you can claim for. These include items like data or internet expenses, electricity usage, rent, rates and cleaning costs. The claimable amount is based on how much of your home is taken up by your office space.

To work out what you can claim, you must work out what percentage of your home’s floor space is taken up by your dedicated workspace. You can only claim for that percentage of your expenses because the rest is for personal use.

If you’re a remote worker who uses a coworking space like The Workspace, those office fees are still claimable as a business expense. This applies to freelancers and remote workers who are employed full time by a company.

Documents you need to support your claims:

Regardless of your business structure, tracking your expenses regularly is key to managing your finances effectively, maintaining positive cash flow and ensuring accurate record-keeping.

For some of these expenses, it might be necessary to show the ratio between business and personal use. For example, if you use your personal phone for work, you’ll need to show what usage is business-related versus what usage is personal. You can only claim for business usage.